New digital technologies make managing money and buying the things you need easier. But the rise in apps, digital wallets, and online shopping also is a thief’s paradise, with consumers losing billions to fraud each year. Scammers are becoming smarter at hacking into company systems, stealing sensitive data, and using it to defraud innocent victims. Learn how to recognize common scams and protect yourself in 2025. AI-powered fraud Criminals are now launching phone and email campaigns using artificial intelligence to…

Read More

As text messaging becomes more prevalent around the world, text message scams are also becoming more common. The fraudsters sending these messages continue to evolve their techniques, getting increasingly convincing to lure personal information. This personal information can be used to access bank accounts or other online accounts like your email. Smishing uses highly convincing text messages to trick someone into providing private information or downloading malicious programs to a mobile phone. What is smishing? Another term for scam text messages,…

Read More

Internet fraud is on the rise. Many of these scams used spoofing, when fraudsters pretend to be a legitimate organization or company. Read on to learn how to spot spoofing and other common methods used by scammers online. What is spoofing? Spoofing is when a fraudster uses an email address, sender name, phone number or website URL to try and convince you that you’re dealing with a trusted source. Sometimes, fraudsters have the technology to trick your phone or computer…

Read More

To protect yourself, it’s important to be familiar with trending scams — keep reading to learn about the latest. Never share your online banking User ID or password. MCFCU will NEVER contact you and ask for it — and there’s no reason anyone else needs it, ever. Student loan scams Americans lost an astounding $5 billion to student loan fraud in 2022. As students graduate high school and look to college in the fall, scammers are busier than ever. And if…

Read More

Fraudsters use all sorts of methods to steal information and gain access to your accounts — including pretending to be from Midwest Community or another financial institution. It’s rare that we will call you, and if we do, we’ll never ask for any of the information below. Beware of requests coming in via text message and email too — those are other ways that fraudsters are stealing information. Print out or bookmark this page so you have a handy reference…

Read More

Your Social Security number (SSN) is one of the most important pieces of personal information you have. Not only does your unique nine-digit number enable you to receive benefits from the Social Security Agency (SSA), but it’s also required when applying for jobs or signing up for programs run by the federal government. Unfortunately, Social Security numbers are also the key to identity theft — and there are all sorts of ways for a thief to use your SSN for criminal purposes. Besides trying…

Read More

Preventing Elder Fraud and Financial Exploitation

Fraud Money Management

Financial loss from elderly fraud is in the billions annually. Seniors are the fastest-growing population segment in Ohio and the Scripps Gerontology Center projects more than 1 in 4 Ohioans will be age 60 and older by 2025. Unfortunately, that growth has contributed to high rates of fraud and financial exploitation targeting the elderly in our state. The national rate of elder financial abuse is also high, with 1 in 20 cases of seniors falling victim to the crime, according…

Read More

Get Informed and Be Better Protected from Fraud

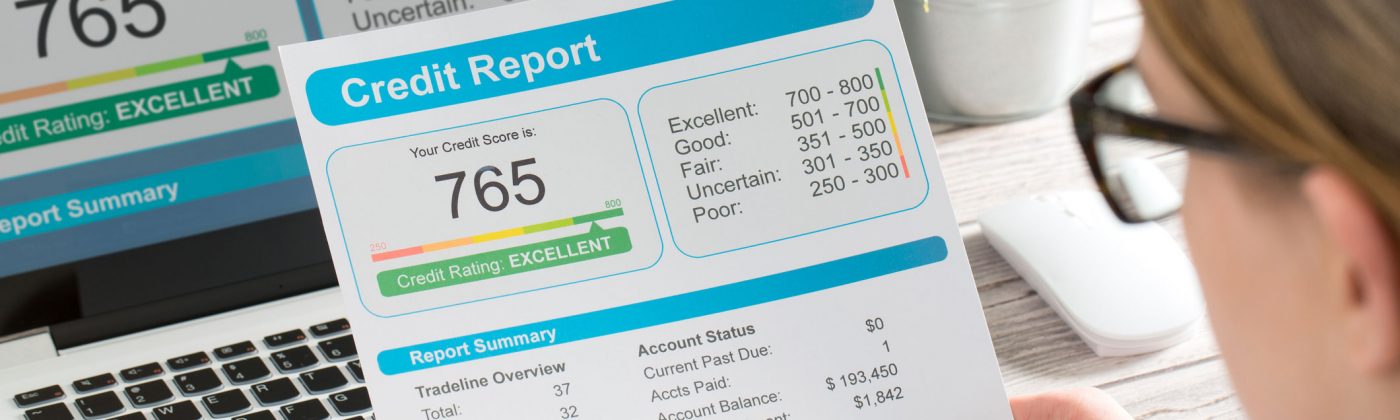

Credit Score Fraud

On average, Ohioans consider themselves adept at protecting their personal information, but research suggests that may not be enough to keep identity thieves at bay. According to an Ohio Credit Union League 2019 consumer survey, about 90 percent consider themselves to be well-informed consumers when it comes to protecting themselves from identity theft. That fits with the national trend. Across the U.S., consumers have become increasingly aware that their personal information needs protection. Since stories about data breaches have become…

Read More

Top 5 Facebook Scams

Fraud

Facebook now has over a Billion users, that’s a mind-boggling number of people who check their page regularly. The bad guys are irresistibly attracted to a population that large, and here are the Top 5 Scams they are trying to pull off every day of the year. Who Viewed Your Facebook Profile: This scam lures you with messages from friends or sometimes malicious ads on your wall to check who has looked at your profile. But when you click, your profile will be…

Read More

Why checking your credit score can pay off

Credit Score Fraud

For many, credit scores come with judgment, risk, and security, which is why many Ohioans are paying attention to them. In an Ohio Credit Union League 2018 consumer survey, 73 percent of respondents reported checking their credit scores within the past six months. That’s compared to 18 percent who had checked within the last year, and 8 percent who’d last sought their scores more than a year ago. The average American isn’t quite as conscientious. According to a survey from…

Read More